Multistate Tax Return Accountant

in Elkins, West Virginia

Carte Hall Certified Public Accountants, located in Elkins, WV, specializes in multi-state tax returns. Multi-State tax returns must be filed when one has worked or lived in more than one state during the tax year. This can become confusing and challenging when trying to do your own tax returns. Our expert team has handled many multi-state tax returns and will assist you by providing relevant tax advice, answering your questions, and ensuring that you are filing properly to receive the maximum benefits for you and/or your business.

When Do I Need to File Taxes in Multiple States?

Many of our clients have questions regarding when taxes must be filed in more than one state. Some states have reciprocal agreements, while others do not. If you are unsure, it is best to contact the tax professionals at Carte Hall for accurate advice. If you are a business owner, you should ensure that you withhold the appropriate amount of taxes from employee payroll. If any of the following situations apply to you, a multi-state tax return may be due for this year:

- Moved During the Tax Year

- Investment Income in Multiple States

- Property Owned in Multiple States

- Lived in One State and Worked in Another State

- Worked in Multiple States

- Business Owner in Multiple States

- Military Personnel Working a Non-Military Job Outside of Filing State

Resident and Nonresident WV State Income Tax Return

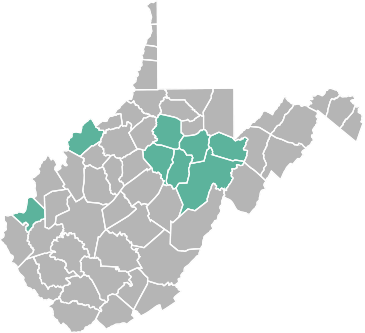

When dealing with multi-state tax returns, one has to first file a resident state tax return plus one or more non-resident state tax returns. Our trusted team can help you understand if you need to file with multiple states, as the rules can become confusing when dealing with moving permanently or temporarily, as well as when investment income includes property, stocks, bonds, etc. in other states. If you think your situation may warrant filing more than one state tax return, it is best to trust your tax returns to the professionals. We offer personalized services to help you get the most accurate and satisfying results. Carte Hall provides multi-state tax return assistance for residents in the following counties:

Multistate Tax Returns by the Professional CPAs at Carte Hall

Carte Hall is trusted by more residents and business owners than any other accounting firm in the area. Our CPAs provide experienced, professional assistance for all of your accounting and tax return needs. For more information regarding how we can help you and your business navigate multi-state tax returns, contact us at: 304-637-2369.