Tax Preparation Service

Individual, Business, Gift, and Fiduciary Income Tax Returns

Taking the Stress Out of Tax Time In Elkins, WV

Carte Hall Certified Public Accountants in Elkins specializes in providing precision income tax preparation services for individuals and business owners, as well as personal representatives, estate administrators, and those responsible for paying taxes for gifts in cash or assets that exceed the annual exclusion. We work closely with you to answer your questions and provide the support you need to be confident that your taxes are completed accurately, competently – and in your best interest. When you choose our team, we ensure compliance while minimizing your tax burden to the fullest possible extent of the law. You can expect a custom strategy tailored to meet your needs.

- Qualified Certified Public Accountants

- Fair Rates

- Multi-State Tax Returns

- Secure Client Portal

- Electronic Filing

- Private (Gramm-Leach-Bliley Act Compliant)

- Exceptional Customer Service

WE KNOW THE TAX LAW

LET US PUT OUR KNOWLEDGE TO USE FOR YOU

It’s no secret that our tax system is extremely complicated – and failure to abide by the US Tax Code can have extreme implications. Rather than taking that chance, contact us to ensure your tax return is completed accurately. At Carte Hall, we are well-positioned to optimize your tax return while providing strategic support.

Individual Tax Return Preparation

Carte Hall Certified Public Accountants offers immense value to our individual tax return clients. You can count on us to help navigate the complexities of the tax code, avoid drawing the ire of the IRS, assist with a wide range of tax planning needs, and minimize your deductions and tax liability so you can keep more of your earnings. Our friendly, knowledgeable staff are always available to answer your questions. We handle virtually all types of individual tax returns and make the entire process as stress-free as possible.

Business Tax Return Preparation

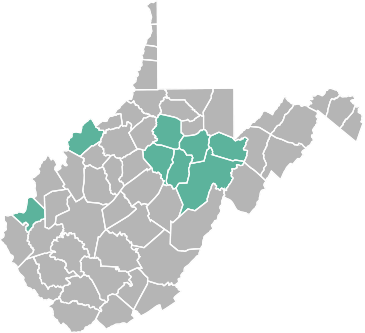

Carte Hall Certified Public Accountants is the preferred choice of business professionals throughout all of north-central West Virginia, including Randolph, Barbour,

Upshur, Lewis, Tucker, Wood, Harrison, and Cabell County. We can handle everything for you in the most efficient and effective manner. Our accountants offer easy-to-use., streamlined tax planning and preparation services, as well as a full range of accounting services and solutions for your business. Let us help you pay yourself and your team well, identify developing issues, and mitigate them before they become major problems. Our experienced accountants offer the support you need to guarantee compliance with tax laws and verify the accuracy of your business’s tax return data. To learn more about what we can do for you, please contact us to schedule a consultation.

Gift Tax Return Preparation

Of all the areas we handle here at Carte Hall Certified Public Accountants, the gift tax return remains one of the most confounding subjects for many clients – and for good reason. The IRS laws regarding gift and estate taxes are quite complex. Navigating them can be cumbersome. With hefty penalties and tax levies possible for filers (and heirs on down the line) even decades after an innocent mistake on Form 709, it makes sense to have a knowledgeable accountant help you handle the preparation of this form. At Carte Hall Certified Public Accountants, we invite you to access our in-depth knowledge of the rules for the gift tax and “generation skipping tax” to make the best decisions for yourself – and your estate.

Fiduciary Income Tax Return Preparation – Elkins, WV

Trusts and Estates

Have you been appointed as the trustee of a trust? Did a loved one die, leaving you to be appointed as the executor, executrix, or administrator of an estate? If so, you are considered the fiduciary of that trust or estate – and responsible for accurately overseeing all aspects (including filing tax returns).

It is important to keep in mind that the Internal Revenue Service views decedents and their estates as separate taxable entities – and the rules are different for each. It can sometimes be difficult to determine exactly what property and assets should be reported on each type of return and the rules continually change. If you would like to ensure that your fiduciary duty is carried out appropriately, in accordance law, and that you are properly submitting all taxes due while allowing the trust or estate to claim all legal deductions, we can help. Carte Hall Certified Public Accountants in Elkins can assist you with all aspects of preparing and filing the federal Form 1041 (US Income Tax Return for Trusts and Estates), as well as relevant local and state returns within our service jurisdiction.

Why Should I Choose a Certified Public Accountant to Prepare My Tax Return?

We’re glad you asked. In West Virginia, there are no minimum competency standards for paid tax preparers. Before handing over your tax return information, ensure your tax preparer has the knowledge, training, and expertise to do the job correctly. Choosing a state-licensed certified public accountant (CPA) or federally licensed enrolled agent from the financial experts at Carte Hall. In order to maintain our licenses, CPAs and enrolled agents are required to prove expertise – and mandated to work in your best interest according to relevant laws and applicable frameworks. When you choose Carte Hall Certified Public Accountants you can rest assured that every possible deduction will be claimed, you will not pay one penny more than you owe – and you can sleep easy every night knowing that if the IRS decides to pay a visit, they will just be wasting their time.

Contact the Professional CPAs at Carte Hall

Carte Hall is the most trusted accounting firm in the area. Our CPAs are here to guide you through your accounting and tax needs. We provide the professional support you need to succeed. For more information about how we can help you (or your business) navigate tax season, contact us at: (304) 637-2369.